The latest announcement from the Shanghai Micro Electronics Equipment Group (SMEE) could herald a shift in the global technology landscape, especially the chip-making industry. SMEE’s planned unveiling of a scanner capable of producing chips based on a 28nm process technology is, no doubt, a significant leap from its previous production capabilities, restricted to 90nm nodes.

A defining aspect of this shift is that this scanner, the SSA/800-10W, comprises domestically developed and manufactured components, underscoring China’s broader strategy of self-reliance in tech manufacturing. In fact, this strategy appears to have had positive reverberations across the sector, with stocks for local optical component manufacturers, including Mloptic, Kingsemi, and Castech, witnessing an uptick.

Yet, the optimism must be tempered with pragmatism. The production capacity of SMEE and the feasibility of mass-producing this advanced lithography machine remains a critical, unresolved issue. Overcoming this hurdle is pivotal for China’s ambitious plan of reducing its dependence on foreign wafer fab equipment, an industry currently dominated by giants like ASML, Canon, Nikon, and Tokyo Electron.

Similar Post

With the escalating tech war and stringent restrictions from the U.S., Japan, and the Netherlands, Chinese chipmakers are feeling the heat. Semiconductor Manufacturing International Corp. (SMIC) and Hua Hong Semiconductor, prominent Chinese chipmakers, are essentially blocked from procuring 14/16nm-capable tools, underlining the importance of SMEE’s potential breakthrough.

However, the devil is in the details—or in this case, the lack of them. The actual capabilities of this machine, as compared to its foreign counterparts, remain shrouded in mystery. Equally unclear is the speed at which these machines can be produced to expedite China’s chip development.

One cannot overlook the broader geopolitical implications either. The U.S.’s attempts to throttle Chinese chip development could ironically backfire, potentially excluding the Western market from low-cost chips. The situation also demands an innovative response from China, particularly with artificial intelligence (AI) being another variable in this high-stakes tech war. How China manages to leverage its resources for AI development, in the face of probable restrictions, could well determine the future contours of this conflict.

The technological breakthrough by SMEE offers a tantalizing glimpse into China’s potential for self-reliance in chip manufacturing. Yet, the path ahead is fraught with uncertainties and challenges. How these issues are resolved, and the strategic responses they elicit from global powers, could define the next chapter of the ongoing tech war.

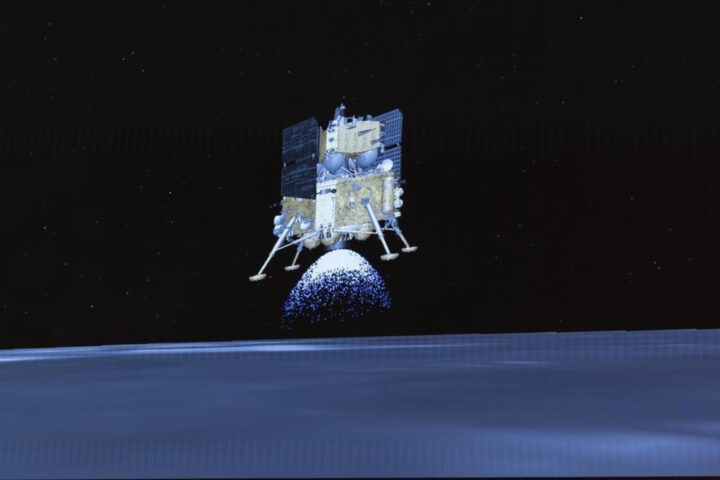

![This image taken from video animation at Beijing Aerospace Control Center (BACC) on June 2, 2024 shows the lander-ascender combination of Chang'e-6 probe landing on the far side of the moon. [Photo/Xinhua]](https://www.karmactive.com/wp-content/uploads/2024/06/spp.jpeg)