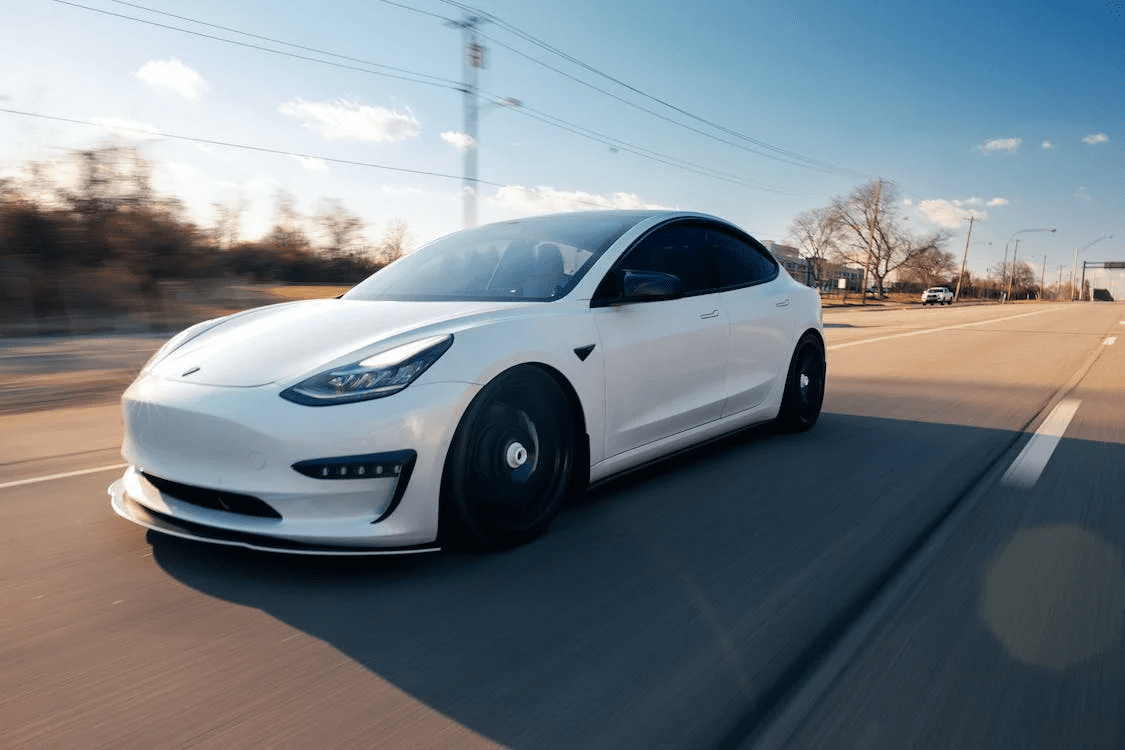

With Tesla’s recent, recurrent price cuts, the spotlight in the EV industry has shifted dramatically, sparking renewed intrigue. In a market accustomed to high price tags for electric vehicles, Tesla’s move to lower its prices, especially for the Model 3, to as low as $37,940 has flung open doors to potential buyers who were previously hesitant. Once the U.S clean vehicle tax incentives are factored in, this figure is further reduced to a strikingly affordable $30,000.

Tesla’s price drop serves as a strategic chess move in a field where the competition is intensifying, compelling rivals to rethink their approach. Notably, Ford’s recent inventory surplus issues underscore a market wherein supply and demand have finally found equilibrium. Yet, amidst these price cuts, Tesla’s profitability is a concern that has inevitably raised eyebrows and is reflected in its declining stock price, down nearly 10% following Q2 earnings report.

Simultaneously, the price reductions foreshadow the launch of the impending Model 3 Highland refresh. The expectation is to clear existing inventory to make way for the revised model, a classic move for any manufacturer in the face of a product upgrade. The anticipated Model 3 refresh, teased since April, is speculated to arrive by Q3 2023. However, Tesla’s track record suggests potential delays.

Tesla’s unique approach is evocative of a “paradoxical bargain,” a strategy involving seemingly unrealistic offers designed to stoke the consumer’s interest. Essentially, they’re selling Model 3s for less than manufacturing costs, banking on the surge in demand this tactic might ignite. While this does raise the risk of financial loss, there is a considerable upside if the increase in sales volume offsets the reduced margins.

Similar Post

But what lies beneath this strategy? One aspect is Tesla’s relentless pursuit of cost reduction through the simplification of the manufacturing process and the use of more cost-effective materials. This approach maintains the quality of the vehicles while allowing for more competitive pricing, positioning Tesla as one of the most affordable EV manufacturers.

As fascinating as this pricing strategy is, it’s also a reminder of the potential risks. Selling under cost price is a precarious path to tread, and Tesla will need to navigate this strategy cautiously to ensure sustainability. Even the most innovative companies can stumble if the balance between demand generation and financial viability isn’t deftly maintained.

Elon Musk’s audacious moves have always made waves, and this price cut is no exception. It could either cement Tesla’s position as a disruptive force in the automotive industry or expose them to significant financial risk. The success of this strategy hinges on how well Tesla can execute this paradoxical bargain and how the market responds.

The EV world watches with bated breath as this audacious play unfolds, marking yet another riveting chapter in Tesla’s journey and potentially altering the EV industry’s landscape. However, the real verdict will emerge only in the fullness of time.