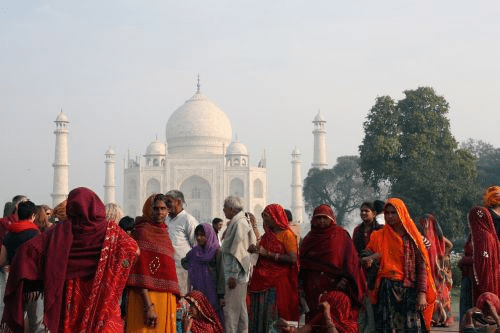

Inequality in India has grown in a tremendous amount where the bottom 50% of the population possess only 3% of the total wealth. And just 5% of Indians own more than 60 % of the country’s wealth.

The platitude “Rich are getting richer and the poor are getting poorer” is substantiated by the report published by Oxfam titled “Survival of the Richest: The India story”.

Statistics from the report paint a devastating but predictable picture of Indian society as we know it. The report finds some stark disparities that indicate the deepening chasm between the rich and the poor and provides a solution to combat this inequality: through progressive tax measures.

- Since the pandemic began in Nov 2022, billionaires in India have seen their wealth surge by 121%, or INR 3608 Crore per day in real terms.

- Approximately 64 percent of the total INR 14.83 lakh crore in Goods and Services Tax (GST), came from the bottom 50 percent of the population in 2021-22, and only 3 percent of GST came from the top 10 percent.

The Oxfam report terms this economic arrangement as an “obscene inequality” and urges the Union Finance Minister to implement progressive tax measures such as wealth tax in the upcoming Union Budget.

“While the country suffers from multiple crises like hunger, unemployment, inflation, and health calamities, India’s billionaires are doing extremely well for themselves. The poor meanwhile in India are unable to afford even basic necessities to survive. The number of hungry Indians increased to 350 million in 2022 from 190 million in 2018. The widespread hunger is resulting in 65 percent of the deaths among children under the age of five in 2022, according to the Union Government’s submission to the Supreme Court. After witnessing mass suffering and death during the COVID-19 pandemic, it was critical that the Government of India took aggressive measures to address injustice and poverty. But it has unfortunately lost the plot. India is unfortunately on a fast track to becoming a country only for the rich.” said Amitabh Behar, CEO of Oxfam India.

While the poor continue to struggle for the most basic necessities like education, healthcare, and housing, the richer sections continue to ride on the train of opulence, earning an absurd amount of money. The wealth of the top 10 richest can finance the Ministry of Health and Family Welfare and the Ministry of Ayush for more than 30 years can finance India’s Union education budget for 26 years or can fund the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) for 38 years.

The report also highlights the complicity of banks in this late capitalist horror. The brutal loan recovery measures employed on the poor and the marginalized, like on the 22-year-old pregnant woman in Jharkhand who was crushed under a tractor for not paying 10,000 EMI, are replaced with benevolence for corporates who were loaned INR 11.17 lakh crore. Only 13% of this amount is recovered. Further to alienate and ghettoize the poor, RBI has withdrawn its curb on third-party recovery agents.

A revolting facet of this inequality materializes in the Indian healthcare sector. Many ordinary Indians are not able to access the health care they need. 63 million of them are pushed into poverty because of healthcare costs every year – almost two people every second. The public health care system has failed the common Indian immensely. The condition of government hospitals is despicable, characterized by deprivation, and lack of adequate resources, and medical professionals. The poorest Indian states have infant mortality rates higher than those in sub-Saharan Africa. India accounts for 17% of global maternal deaths, and 21% of deaths among children below five years.

Amitabh Behar, CEO, of Oxfam India said, “The country’s marginalized – Dalits, Adivasis, Muslims, Women, and informal sector workers are continuing to suffer in a system which ensures the survival of the richest. The poor are paying disproportionately higher taxes, spending more on essential items and services when compared to the rich. The time has come to tax the rich and ensure they pay their fair share. We urge the finance minister to implement progressive tax measures such as wealth tax and inheritance tax which have been historically proven to be effective in tackling inequality.”

Greater taxation creates an enabling environment for governments to have resources to fund universal public services, climate adaptations, and innovations. The crumbling public health structure in India, the underfunded education system, and the housing crisis can only be mitigated through the redistribution of wealth.

“It’s time we demolish the convenient myth that tax cuts for the richest result in their wealth somehow ‘trickling down’ to everyone else. Taxing the super-rich is the strategic precondition to reducing inequality and resuscitating democracy. We need to do this for innovation. For stronger public services. For happier and healthier societies” said Gabriela Bucher, Executive Director of Oxfam International.

Some key statistics

| 1% | The top 10% of the Indian population holds 77% of the total national wealth. 73% of the wealth generated in 2017 went to the richest 1%, while *670 million Indians who comprise the poorest half of the population saw only a 1% increase in their wealth. |

| 70 | There are 119 billionaires in India. Their number has increased from only 9 in 2000 to 101 in 2017. Between 2018 and 2022, India is estimated to produce 70 new millionaires every day. |

| 10x | Billionaires’ fortunes increased by almost 10 times over a decade and their total wealth is higher than the entire Union budget of India for the fiscal year 2018-19, which was at INR 24422 billion. |

| 63 M | Many ordinary Indians are not able to access the health care they need. 63 million of them are pushed into poverty because of healthcare costs every year – almost two people every second. |

| 941 yrs | It would take 941 years for a minimum wage worker in rural India to earn what the top-paid executive at a leading Indian garment company earns in a year. |