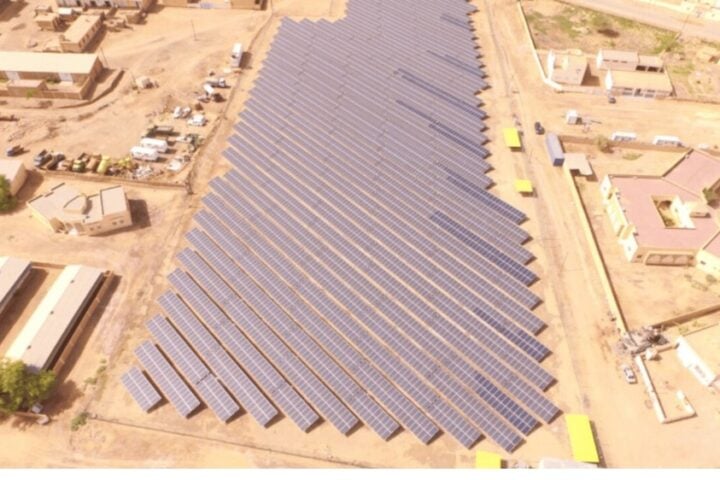

The governments of South Africa, the Netherlands, and Denmark have reached a significant milestone by concluding a Heads of Agreement (HoA) to establish the SA-H2 Fund. This innovative blended finance fund aims to accelerate the development of the green hydrogen sector and circular economy in South Africa. Supported by Climate Fund Managers (CFM), Invest International B.V., Sanlam Limited, the Development Bank of Southern Africa (DBSA), the Industrial Development Corporation of South Africa (IDC), and other strategic partners, the SA-H2 Fund intends to secure $1 billion in funding. This capital will be raised directly within South Africa or through other channels, with the primary goal of expediting the mobilization of funds for the construction and development of large-scale green hydrogen infrastructure assets across the country.

Andrew Johnstone, the CEO of CFM, expressed his enthusiasm for the SA-H2 Fund, highlighting its significance as the second-of-its-kind regional blended finance fund for green hydrogen projects. The fund aims to leverage the advantages of hydrogen as a cleaner alternative to carbon-intensive fuels, reducing emissions and environmental impacts. Moreover, hydrogen offers efficient energy storage and utilization capabilities, ensuring a reliable supply of energy from intermittent renewable sources. Hydrogen energy is considered to hold the potential to address the climate crisis and could help the transition to a low-carbon economy,

South Africa, with its abundant wind and solar resources and existing industrial capacity, is well positioned to become a key producer of green hydrogen. The establishment of the SA-H2 Fund marks a significant milestone in attracting private-sector investment to the industry and promoting the development of a circular economy. This groundbreaking initiative will be supported by contributions from state finance institutions such as the DBSA and the Industrial Development Corporation of South Africa Ltd., as well as Sanlam Ltd. and Climate Fund Managers BV.

The planned fund can support South Africa’s plans to transition away from coal. It prepares to implement an $8.5 billion climate finance pact with some of the world’s wealthiest nations. Additionally, Denmark and the Netherlands are in discussions to join the Just Energy Transition Partnership, further solidifying international collaboration on green energy initiatives.

Catherine Koffman, Group Executive: Project Preparation at the DBSA, emphasized the innovative blended finance architecture and structuring that will be utilized to establish a substantial pipeline of green hydrogen projects in South Africa. This approach will provide private sector developers with access to risk capital throughout all stages of project development, construction, and operations. The SA-H2 Fund represents a significant addition to national efforts to leverage existing renewable energy infrastructure. With a national target of $250 billion in green hydrogen investment by 2050, this sector is expected to have a profound development impact on the renewable energy industry. The fund’s acceleration of critical green hydrogen infrastructure development will stimulate economic growth, foster skill development, create employment opportunities, generate export revenues, and facilitate the decarbonization of South Africa’s economy and industry.

President Cyril Ramaphosa expressed gratitude to the companies and institutions from the Netherlands, Denmark, and South Africa for their investment announcements and partnerships. He acknowledged the importance of developing green hydrogen projects that contribute to the export market while benefiting local economies in South Africa.