Pfizer has pulled the plug on danuglipron (PF-06882961), its experimental once-daily oral GLP-1 receptor agonist for weight management, after a participant in an early-stage dose-optimization trial developed potential drug-induced liver injury (DILI). Though the patient remained asymptomatic and liver enzymes normalized quickly after discontinuation, this safety signal—combined with regulatory feedback—prompted Pfizer to halt development before advancing to costly Phase 3 trials.

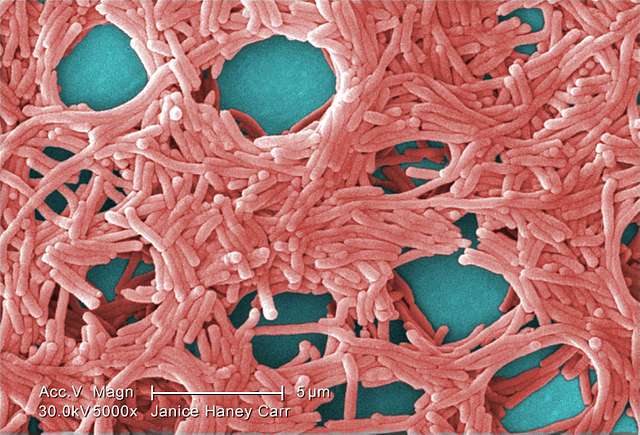

The termination adds to Pfizer’s growing list of obesity treatment failures in a market projected to reach $150 billion by the early 2030s. In December 2023, Pfizer abandoned the twice-daily danuglipron formulation when Phase 2b trials revealed intolerable gastrointestinal side effects—73% of participants experienced nausea, 47% reported vomiting, and 25% suffered diarrhea, driving dropout rates above 50%. Six months earlier, in June 2023, Pfizer had scrapped lotiglipron, another oral GLP-1 agonist, also due to liver enzyme elevations.

“While we are disappointed to discontinue the development of danuglipron, we remain committed to evaluating and advancing promising programs in an effort to bring innovative new medicines to patients,” said Dr. Chris Boshoff, Pfizer’s Chief Scientific Officer, in the company’s announcement.

Pfizer emphasized that across its safety database of 1,400+ patients, liver enzyme elevations generally matched rates seen with approved GLP-1 medications. The critical DILI case occurred during rapid dose-escalation studies designed to determine optimal dosing parameters for potential late-stage development.

Currently, Eli Lilly’s Zepbound (tirzepatide, a GLP-1/GIP dual agonist) and Novo Nordisk’s Wegovy (semaglutide) dominate the weight loss market as weekly injectables. Zepbound generated $5 billion in 2024 sales despite only receiving FDA approval in November 2023. The only FDA-approved oral GLP-1, Novo Nordisk’s Rybelsus (semaglutide), is currently indicated for diabetes and brought in $3.38 billion in 2024 sales.

This market reality creates enormous pressure to develop effective oral weight loss options. GLP-1 agonists work by mimicking gut hormones that regulate appetite and blood sugar, slowing gastric emptying and increasing satiety signals in the brain. While injectable formulations bypass digestive challenges, oral drugs must survive stomach acid, resist enzymatic degradation, and achieve adequate bioavailability—scientific hurdles that have proven difficult to overcome while maintaining safety. Following Pfizer’s announcement, market reactions were swift. Eli Lilly shares rose 2.6%, Novo Nordisk climbed over 3%, and smaller obesity drug developers like Viking Therapeutics and Structure Therapeutics jumped 8-10%. Pfizer stock increased just 1%, reflecting already-tempered expectations after previous setbacks.

Similar Posts

Pfizer’s obesity strategy now rests on earlier-stage candidates, including an oral GIPR antagonist (PF-07976016) in Phase 2 trials and another oral GLP-1 receptor agonist in Phase 1. This approach differs from Eli Lilly’s tirzepatide, which activates both GLP-1 and GIP receptors, while Pfizer is exploring whether blocking GIP might offer different efficacy or tolerability profiles.

BMO Capital Markets analyst Evan Seigerman stated the discontinuation sends Pfizer “back to the starting block” in the obesity race, suggesting the company might need acquisitions or partnerships to catch up. This setback intensifies pressure on Pfizer as it faces declining COVID-19 vaccine revenues and looming patent expirations that put approximately $15 billion in annual revenue at risk by decade’s end.

The development of oral obesity medications remains crucial for patient access. While injectables have demonstrated remarkable efficacy, with Wegovy and Zepbound producing average weight loss of 15-20% in clinical trials, oral options could significantly expand treatment reach. Despite recent price reductions, current therapies still cost hundreds of dollars monthly without insurance coverage, creating substantial barriers for many patients.

Pfizer plans to present complete danuglipron data at future scientific conferences or in peer-reviewed journals, potentially providing valuable insights for the broader field of oral weight loss drug development.