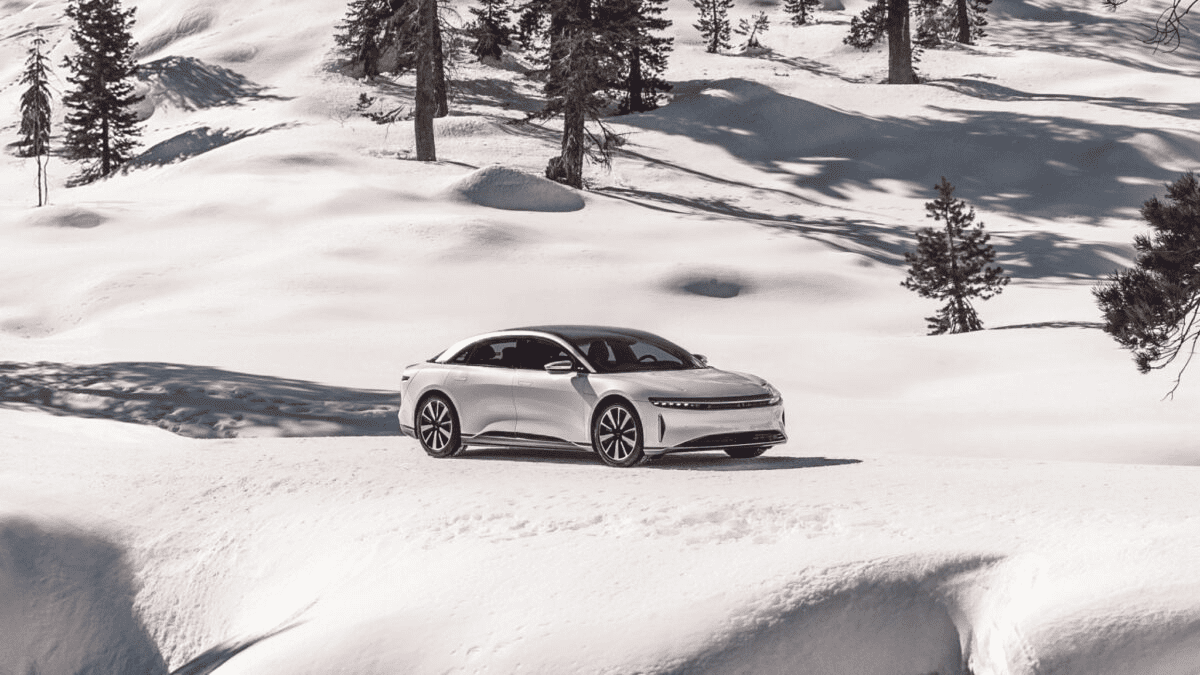

Lucid Group Inc recently announced that it would be offering a $7,500 credit to customers purchasing select variants of its Air luxury electric car. The move is seen as a response to the ongoing price war between Tesla Inc and Ford Motor Company, making it harder for smaller companies like Lucid to grab a foothold in the market. The credit will be available to customers buying Touring and Grand Touring models of the Air series purchased before March 31, 2023.

Despite the fact that Lucid’s cars are not eligible for the federal tax credit of $7,500, the company believes its customers still deserve the incentive. The Inflation Reduction Act passed in August 2022 limits the credit to a price cap of $55,000, and the Air Touring retails from $107,400, while the Grand Touring model starts at $138,000.

Although Lucid Group Inc and Rivian Automotive Inc shares fell 9% and 2% respectively on Thursday, TSLA and F shares increased by 4.89% and 1%, respectively. Lucid has had a remarkable year-to-date rally, with its shares jumping 69%, outperforming Tesla, which is up by 60% in the same period. The surge has been fuelled by speculation of a takeover by Saudi Arabia’s sovereign wealth fund, which already owns over 60% of the company. The PIF has invested on behalf of the government, which has also propelled the stock price of Lucid Group Inc.

The rally of Lucid’s shares has been the best-performing stock on the Nasdaq Composite. Investors have growing expectations that the Federal Reserve will abandon hikes and start cutting interest rates later in the year to boost the US economy. Equities tend to rally when interest rates fall because the lower cost of borrowing boosts future cash flows that make up part of companies’ valuations. Despite this, some analysts are sceptical about the company’s outlook, as it produced just 7,100 vehicles last year compared to Tesla’s 1.3 million. Long-time bear Adam Jonas believes that the company’s stock is more likely to deteriorate than improve, and he holds a price target of just $5 for the EV manufacturer.