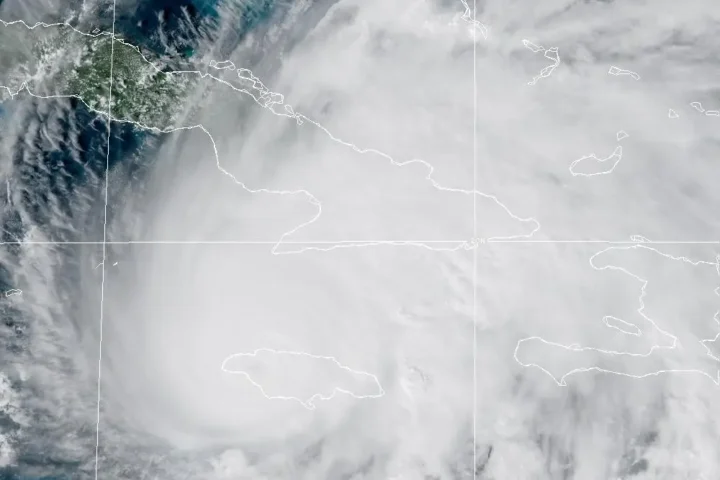

In a world grappling with climate change, businesses are seeking ways to understand and mitigate environmental risks. Enter the Howden Resilience Laboratory – a new digital platform that’s turning heads in the insurance and climate tech sectors.

Launched on September 23, 2024, by international insurance group Howden, this Microsoft-powered hub aims to transform climate risk management. But what exactly does it offer, and how might it impact businesses and investors?

Crunching Climate Data with Cloud Power

At its core, the Howden Resilience Laboratory is a data-crunching powerhouse. It harnesses Microsoft’s cloud services – Azure, Microsoft 365, and Dynamics 365 – to process vast amounts of environmental, societal, and financial data. The goal? To provide actionable insights for managing climate risks.

Lyn Grobler, Howden’s Chief Information Officer, explains: “This collaboration with Microsoft allows us to create a world-class innovation hub powered by data, AI and computation to model climate scenarios and assess financial impacts, which will enable strategic and confident investment decisions that protect assets and businesses.”

From Scenarios to Strategies: What the Lab Offers

The platform’s capabilities extend beyond mere number-crunching. Here’s what users can expect:

- Climate Risk Modeling: Identifies potential risks to operational and financial performance.

- Scenario Planning: Allows users to simulate outcomes of strategic decisions like mergers or market expansions.

- Risk Transfer Solutions: Optimizes investment and insurance strategies.

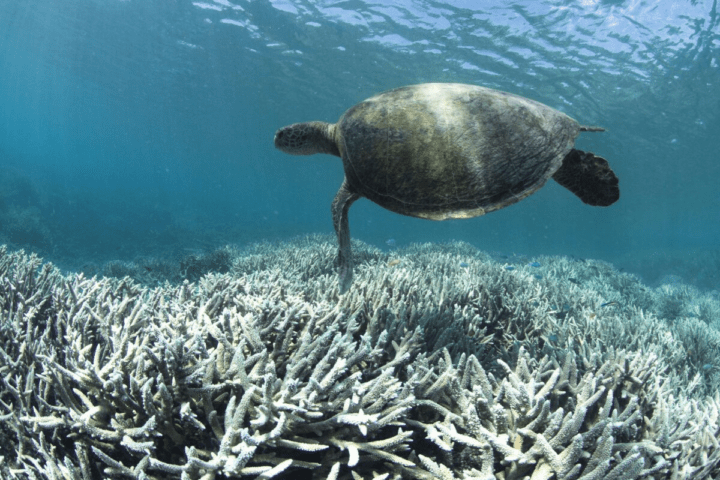

- Resilience Investment Analysis: Evaluates the financial benefits of investments in areas like supply chains and biodiversity.

Real-World Application: Climate Week NYC 2024

Howden and Microsoft plan to showcase the platform’s capabilities at Climate Week NYC 2024. They’ll demonstrate an automated modeling approach that helps real asset investors understand pre-investment climate risks and consider resilience strategies.

This solution aligns with the Physical Climate Risk Assessment Methodology (PCRAM) developed by the Institutional Investors Group on Climate Change (IIGCC). It’s the first of its kind to report on financial metrics like cash flow impacts.

Similar Posts

Mahesh Roy, Investor Strategies Programme Director at IIGCC, notes: “By streamlining the process, the Resilience Laboratory’s application of PCRAM offers the opportunity to broaden its use across sectors, providing insurers and investors with a practical framework to incorporate climate resilience into their decision-making.”

Industry Reaction and Future Prospects

The insurance and tech sectors are taking notice. Bill Borden, Corporate Vice President of Worldwide Financial Services at Microsoft, sees the platform as a game-changer: “The Howden Resilience Laboratory is using technology and data platforms to model, understand, and mitigate climate risks in ways that were previously unachievable.”

However, questions remain about the platform’s long-term impact and adoption rates across different industries. Will it truly change how businesses approach climate risk, or will it be just another tool in an increasingly crowded market?

As climate change continues to pose challenges for businesses worldwide, platforms like the Howden Resilience Laboratory may become increasingly vital. Whether it lives up to its potential remains to be seen, but it’s clear that the intersection of technology, data, and climate science is where many believe the future of risk management lies.