Tropical forests are among the Earth’s most important natural treasures. Yet too often, protected areas with tropical forests lack sustained funding for successful conservation.

A new program for debt-for-nature swaps for long-term conservation is formally established by Congress. This program allows countries to refinance their debts in exchange for redirecting funds towards conservation.

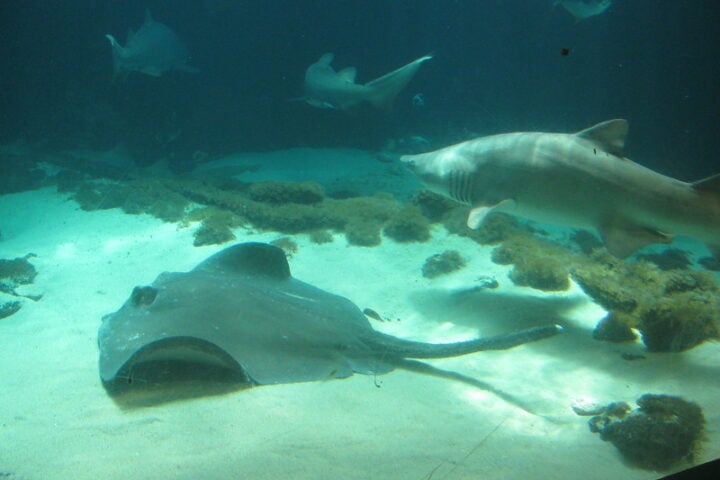

The Act, passed in 1998, was renamed the Tropical Forest and Coral Reef Conservation Act (TFCCA) in 2019 to include an expansion of countries with coral reefs and mangroves. Over $380 million for projects to conserve critical tropical forests and coral reef ecosystems in 14 countries are pledged by the agreements made through this law.

In June 2002, the US and Peruvian governments, supported by WEF, signed a groundbreaking $14 million debt-for-nature swap agreement in exchange for funding dedicated to the preservation of 27.5 million acres of tropical forests.

A 2004 debt-for-nature (DFN) swap supported by WWF established an agreement to reduce Colombia’s debt to the US by over $10 million for 12 years in exchange for funding local conservation projects to protect tropical forests.

WWF, the Nature Conservancy, and Conservation International—these three leading conservation organizations and US leaders in the field—met at an event in Washington, DC, on June 25 to commemorate more than a quarter-century of successful DFN swaps under the law. WWF-US CEO Carter Roberts opened the event by reflecting on the legacy of Tom Lovejoy, WWF’s first chief scientist.“Debt-for-nature-swaps are more than an innovative financial mechanism, they are a means to keep the whole intact,” said Carter Roberts, WWF-US CEO.

One of the reasons why DFN swaps have endured is the support across the political spectrum for their environmental and geopolitical benefits. There may also be potential for utilizing debt-for-nature swaps to expand protections for people and nature. In short, debt-for-nature swaps have protected the world’s tropical forests.

Tropical forests are among the Earth’s most important natural treasures. Yet too often, protected areas with tropical forests lack sustained funding for successful conservation.

A new program for debt-for-nature swaps for long-term conservation is formally established by Congress. This program allows countries to refinance their debts in exchange for redirecting funds towards conservation.

The Act, passed in 1998, was renamed the Tropical Forest and Coral Reef Conservation Act (TFCCA) in 2019 to include an expansion of countries with coral reefs and mangroves. Over $380 million for projects to conserve critical tropical forests and coral reef ecosystems in 14 countries are pledged by the agreements made through this law.

In June 2002, the US and Peruvian governments, supported by WEF, signed a groundbreaking $14 million debt-for-nature swap agreement in exchange for funding dedicated to the preservation of 27.5 million acres of tropical forests.

A 2004 debt-for-nature (DFN) swap supported by WWF established an agreement to reduce Colombia’s debt to the US by over $10 million for 12 years in exchange for funding local conservation projects to protect tropical forests.

WWF, the Nature Conservancy, and Conservation International—these three leading conservation organizations and US leaders in the field—met at an event in Washington, DC, on June 25 to commemorate more than a quarter-century of successful debt-for-nature swaps under the law. WWF-US CEO Carter Roberts opened the event by reflecting on the legacy of Tom Lovejoy, WWF’s first chief scientist.

“This legislation has paved the way for tremendous innovative conservation funding. In just 25 years, the Tropical Forest Conservation Act has helped to protect 68 million acres of forests and coral reefs that have both local and global significance,” said CEO of The Nature Conservancy, Jennifer Morris. “The vision realized more than two decades ago has endured and continues to achieve important conservation wins. TFCCA also served as inspiration for developing TNC’s model of commercial debt refinancing, which is unlocking private funding to help preserve biodiversity and enhance climate resilience.”

“Since Conservation International facilitated the first debt-for-nature swap in 1987, these instruments have grown into a tremendous force, generating hundreds of millions of dollars for conservation efforts that can withstand the test of time,” explained CEO of Conservation International, Dr. M. Sanjayan. “Four decades later, debt-for-nature swaps are more relevant than ever. Sovereign debt continues to swell, and swaps are a tried-and-true way to reduce economic burdens, support local communities, and protect the world’s most valuable ecosystems. It’s encouraging to see the TFCCA evolve to meet the moment, expanding from forest conservation to coral reefs and other key marine habitats.”

One of the reasons why DFN swaps have endured is the support across the political spectrum for their environmental and geopolitical benefits. There may also be potential for utilizing DFN swaps to expand protections for people and nature.

Similar Posts

“Treasury is keen to work with the interagency, with the NGOs, and the whole community to codify principles for debt-for-nature swaps so that the next generation can leverage the learnings,” said Alexia Latortue, Assistant Secretary for International Trade and Development at the Department of Treasury.

Several countries benefiting from the debt-for-nature swaps are identified:

Peru: Noted for a $14 million debt-for-nature swap in 2002 and a subsequent agreement in 2023 that reduces Peru’s debt by over $20 million over 13 years, funding conservation efforts across 60% of the country, particularly in the Amazon rainforest.

Colombia: A 2004 swap helped reduce Colombia’s debt to the U.S. by over $10 million for 12 years, funding conservation projects in regions like the El Tuparro Biosphere Reserve and the Andean Corridor of Oak Forests.

![Representative Image: European Starling [49/366]. Photo Source: Tim Sackton (CC BY-SA 2.0)](https://www.karmactive.com/wp-content/uploads/2025/04/Starlings-Drop-82-in-UK-Gardens-as-Birdwatch-2025-Reveals-Record-Low-Count-Since-1979-720x480.jpg)