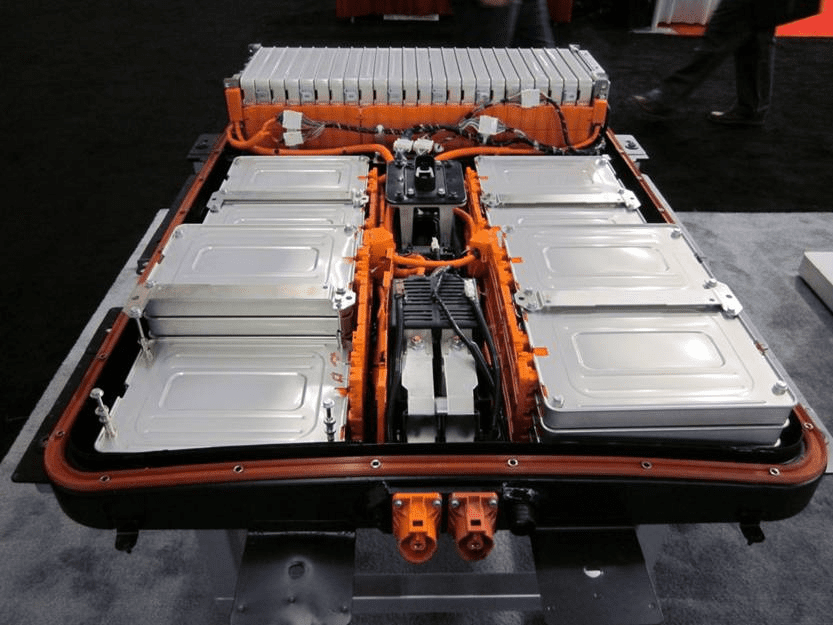

The transport sector stands as one of the most formidable challenges in the quest for decarbonization. Electric vehicles (EVs) present a transformative and sustainable solution, promising reduced air pollution, diminished reliance on fossil fuels, and a decrease in energy imports for the future. However, as with any technological advancement, there are concerns. A significant one is the potential monopolization of the industry. China’s dominance in the EV battery sector is not just due to its competitive labor costs but also its market monopoly on essential components such as minerals, metals, cathodes, and anodes used in battery production.

China’s prowess extends to the recycling of lithium-ion batteries, where it leads globally. As of late 2021, China boasted over three times the existing and planned lithium-ion battery recycling capacity compared to the U.S., holding more than two-thirds of the world’s capacity. A study in the scientific journal ACS Energy Letters further highlights the potential of this market, with projections indicating a growth of over 60% to $18 billion by 2028, as cited by Reuters.

The U.S., recognizing the vast potential of the EV market, is strategically positioning itself to tap into this burgeoning sector. The Inflation Reduction Act of 2022 is a testament to this, with provisions aimed at accelerating EV sales. Notably, the “Advanced Manufacturing Production Credit” in the Act offers tax incentives for domestic battery production over a decade. This legislative change not only boosts U.S. EV battery production but also reduces dependency on Chinese imports.

Similar Posts

In a significant move, the U.S. Department of Energy, in October 2022, awarded Ascend Elements two matching grants totaling $480 million to support the construction of a facility in southwest Kentucky. The company’s ambitious plans involve an investment exceeding $1 billion by the end of 2024, with potential expansions that could see the contract value soar to $5 billion.

Such federal grants could pivot the U.S. towards domestic battery recycling, reducing its dependency on raw material imports. This not only conserves natural resources but also paves the way for more affordable EV options for American consumers.

The industry is keenly awaiting insights from the U.S. Department of Energy on the 2022 Inflation Reduction Act. The Act’s definition of “domestic” recycling is revolutionary, offering a fresh “Made in America” perspective.

Materials like cobalt, lithium, and nickel, pivotal for batteries, are infinitely recyclable, presenting a lucrative opportunity for the future. The U.S. has seen a surge in battery recycling facilities, spurred by the incentives of the Inflation Reduction Act.

China, not one to be left behind, continues to fortify its leadership position with recent policy enhancements and support for recyclers. Data from PitchBook.com reveals a global interest, with around 80 companies involved in EV recycling. Over 50 startups have garnered a staggering $2.7 billion in investments from giants like automakers, battery producers, and mining behemoths such as Glencore (GLEN.L).

Forecasts suggest that by 2030, recycled EV batteries could power approximately 1.5 million EVs. While the U.S. adopts an incentive-driven approach, the European Union leans towards mandates, emphasizing the minimum recycled material content in EV batteries.

Currently, Europe exports shredded EV batteries, termed “black mass,” to China to optimize returns. However, the EU is gearing up to impose stringent conditions on recycled battery materials sourced outside its borders. This move stems from concerns about retaining valuable battery materials within Europe, especially given the potential outflow of used EVs to developing countries.

Innovative solutions are emerging, with countries like Japan exploring leasing models, as seen with Nissan’s EV. As the EV wave surges globally, the spotlight will undoubtedly be on devising efficient, profitable, and sustainable battery recycling strategies.