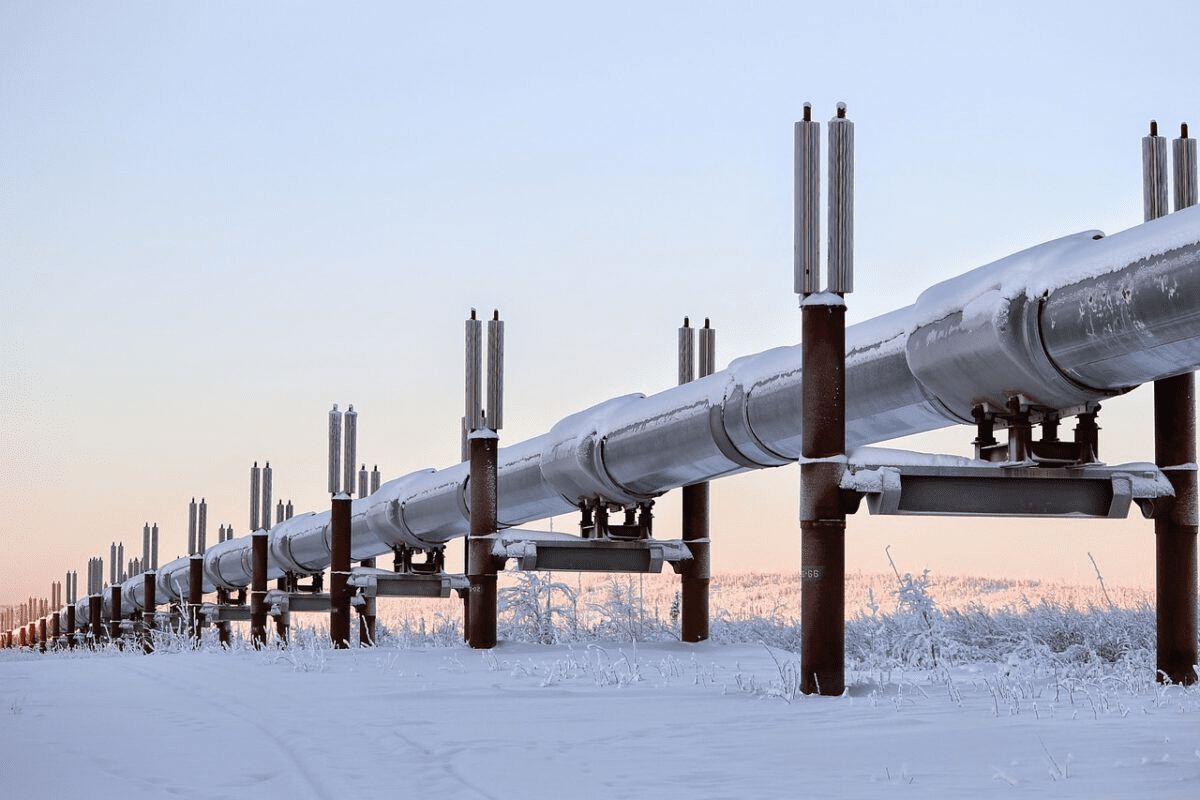

Europe has dodged an energy crisis thanks to a warm winter, but now faces a new challenge with its stockpiles of natural gas that have become a liability. Many countries in the region had hoarded the fuel at higher prices in anticipation of Russia cutting off supplies due to Western sanctions. However, the recent warmer weather has steadied gas prices, with natural gas futures falling by nearly 28% this year, leaving the region with near-record gas inventories. Although projections show that the carryout will be the second-highest on record, the market is oversupplied with too much gas. The surplus in natural gas has declined slightly from the peak, but stocks are expected to deplete to a post-winter low of 606 TWh, slightly down from a projection of 617 TWh.

The Impact Of A Mild Winter

The winter has been mild so far, with heating demands at Frankfurt being 8% below the 10-year average, and 17% below the long-term average. The recent cold spell was not long or severe enough to offset the very mild weather experienced between mid-December and mid-January. While gas reserves have declined in recent days, they remain well above the 10-year average and are providing a strong buffer for any increase in demand. An ongoing cold spell is expected to end soon, and warmer weather is likely to return next week. Reduced consumption by industries, a mostly mild winter, and steady inflows of liquefied natural gas have helped push prices down more than 25% this year. Traders are also waiting for news on the reopening of the Freeport LNG plant in the US, formerly a major supplier to Europe before an explosion last summer shuttered shipments.

Over-Supply Concerns

Although the market has turned around sharply, the European gas market is now oversupplied, moving from fears of shortage last year, to potentially a position of glut later this year if current low demand and strong LNG imports continue. The storage sites could be filled up months in advance if the region does not slow down purchases, according to Morgan Stanley. The bank also suggests that countries within the European perimeter will reach 100% inventory fill as early as August if LNG imports continue at the current pace. The European gas market is facing over-supply issues, and if the region does not slow down purchases, too much gas will be floating around in the market.

- Trump Administration Cuts $12B in Health Grants, States Lose Funding

- Lioness Rescued from Ukraine Gives Birth to Three Cubs at Yorkshire Wildlife Park

- First 2025 Grizzly Bear in Grand Teton Confirmed on March 19

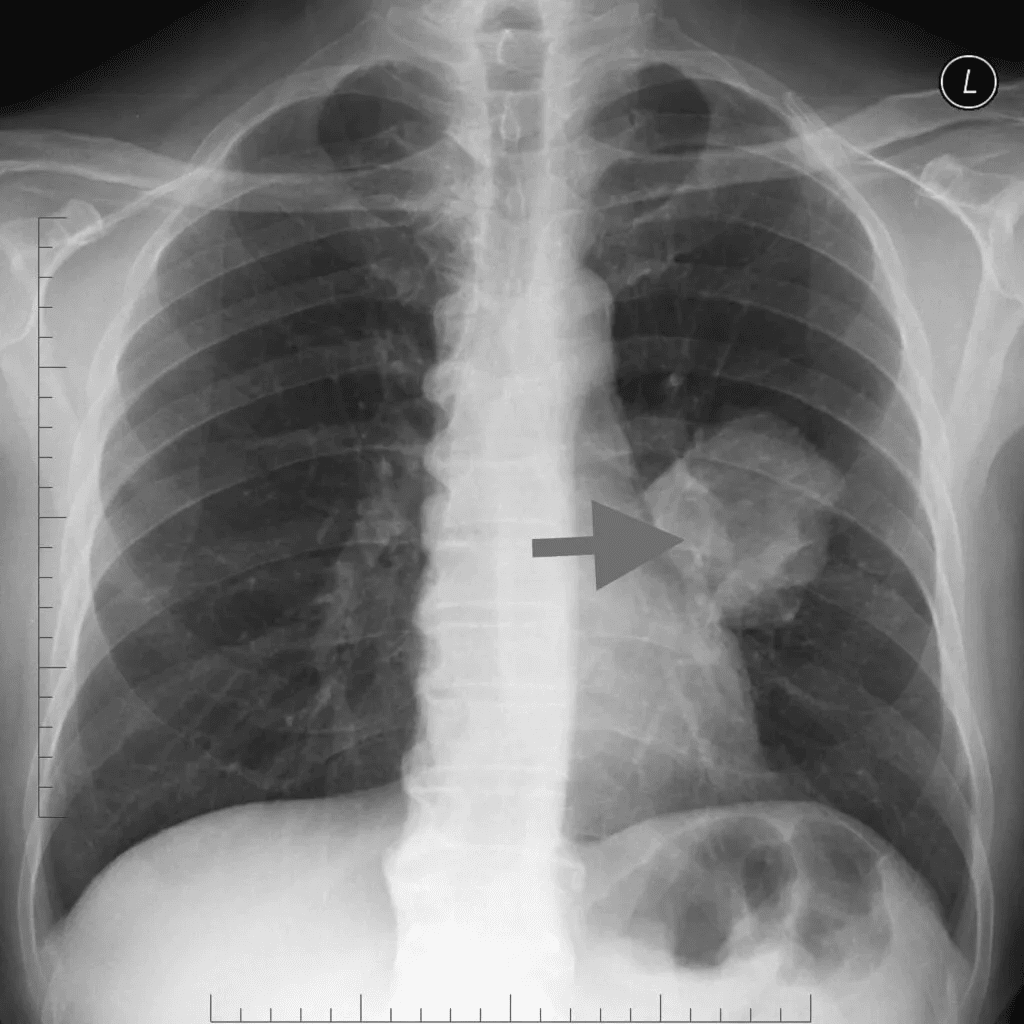

- AI Breath Test Diagnoses COPD in 5 Minutes, Identifies Millions Undiagnosed

- Sydney Light Rail Hits 150M Trips as L1 Dulwich Hill Adds 48 Weekend Services

What’s Next or Europe

Europe managed to avoid an energy crisis thanks to a mild winter, but it is now facing another challenge with its high natural gas inventories that have dropped in value. The surplus in natural gas has declined slightly, but the market is oversupplied. While the weather is expected to warm up, the European gas market will still face challenges from over-supply if the region does not slow down purchases. Therefore, countries need to take measures to prevent an oversupply of natural gas in the market.