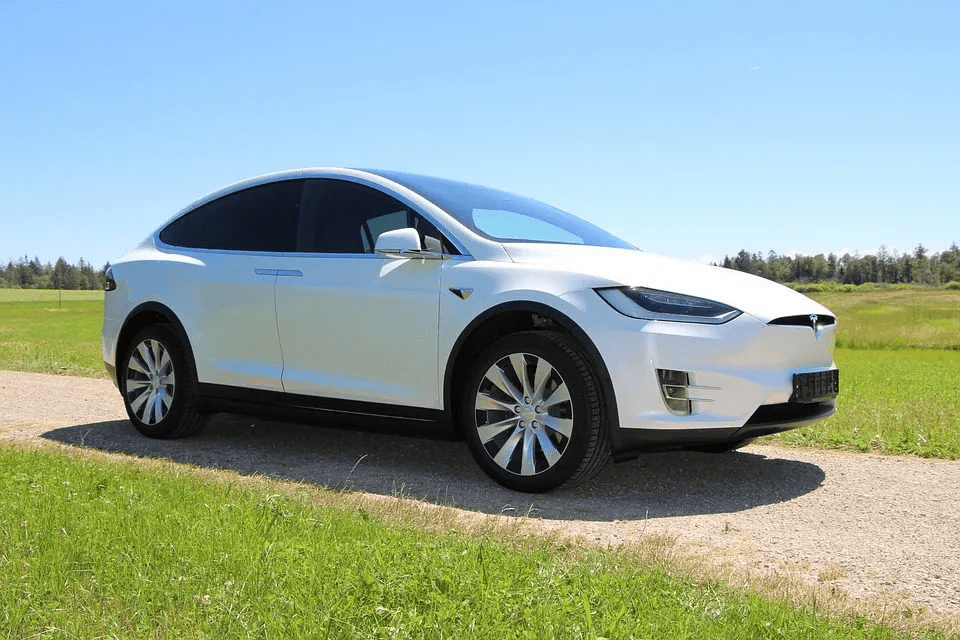

Since some time, Tesla has boasted impressive profit margins. High profits are a direct result of high pricing. All these high pricing tactics have enabled Tesla to play with the EV market whenever it needs to. Recently, Tesla pushed its discounts and incentives to the next level. Tesla dropped the starting price of the Model Y from $65,990 to $52,990. This made the Tesla model eligible for an additional $7,500 US federal EV tax credit.

Tesla’s prices have continued to rise through 2022. However, demand for their vehicles remained persistently high, and waitlists continued to lengthen. Customers were often waiting for months for their vehicle’s delivery. Meanwhile, many opted for competing models due to the prolonged wait. But, high demand and low supply were persistent for every other EV provider.

Tesla’s price cuts are believed to be because it couldn’t meet delivery targets for 50% growth from 2021 to 2022. Despite the lower revenue from the discounts, Tesla’s sales have been rising, also creating a ripple effect on the US and global automotive industries. Initially, the stock price of Tesla may have seen a decline with the announcement of the price cuts, but it has recently been showing signs of recovery due to the increase in sales.

As reported by Teslarati, many automakers, particularly those without a strong presence in the electric vehicle market, are struggling with profitability. The loss of revenue is primarily coming from the sales of plug-in vehicles, as these companies are unable to match the profit margins of Tesla. To maintain sales, they may have to significantly lower prices. According to Bank of America analyst John Murphy, this is the current state of the market.